Energy Stars Align

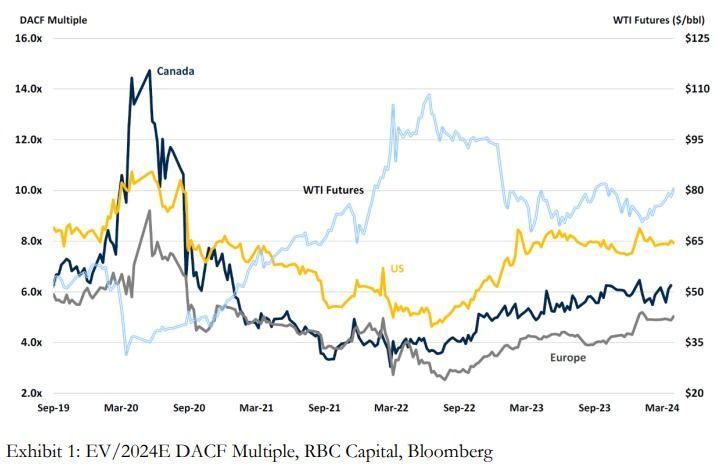

To determine if the oil equities are overstretched, we can look at the debt-adjusted cash flow (DACF) multiples of the major integrated oil names and see how the valuation has shifted in light of the recent oil move. From Exhibit 1, the DACF multiples for the Canadian integrated have been fairly range-bound over the last year, also in line with WTI, which has been in the $70 - $85 range. As a starting point, we can infer that the valuations of the companies have been commensurate with the movements in the underlying oil price deck and in line with where the equities should trade in the cycle historically over the last couple of years. Typically, in the commodities cycle, higher prices are usually coupled with lower multiples as market participants will usually price in lower normalized prices and vice versa, so a cause of concern would be if valuation starts trending towards the 6.5x – 7.0x+ area if oil prices continue to stay in the upper bounds of the $70 - $90 range or higher.

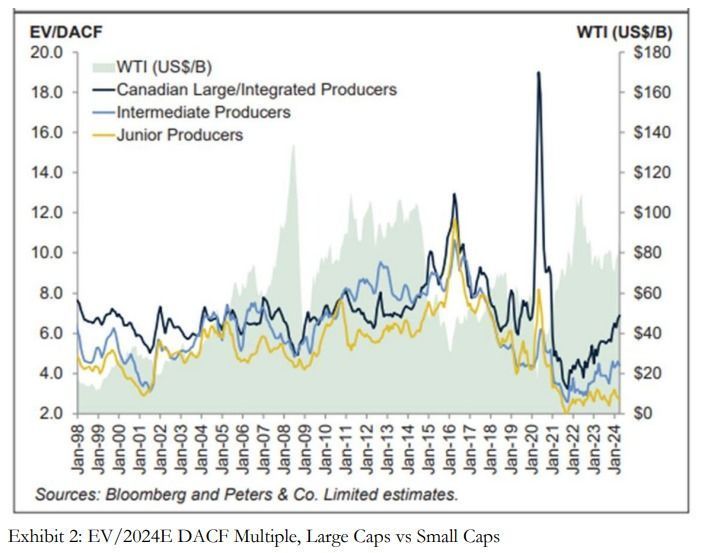

Fast forward to 2022, when the energy crisis was already happening even before the Russian invasion of Ukraine, and now we’re seeing a rush from investors to get back into the space as it becomes harder to justify to your constituents why you’re underweight energy. Given the need to get back into the space quickly, we can see the path of least resistance from many funds to simply buy into more liquid, larger cap names to capture the beta. As the saying goes, no one gets fired for buying Microsoft. The same is probably now true for Canadian Natural Resources or Tourmaline in the energy space. The key takeaway is while we think larger cap oil equities will likely be steady as she goes, given the numerous tailwinds in macro, we think investors will get paid with asymmetric risk-reward if they do the work on some of the intermediate and junior names in the space.

Some have questioned whether the valuation gap between Canadian E&Ps and US E&Ps will tighten over time as we’ve seen a structural discount since pre-COVID. We certainly think there is a case to be made here given the impending commercial operation of the Transmountain Expansion pipeline, which will significantly increase the egress of Canadian oil, a pain point for many years that’s self-inflicted by Canadian politics. Improving egress means better pricing of WCS on the world stage, and lower volatility as a function of WTI price means investors will underwrite higher valuation multiples. Canada’s oil reserves, on a proven and probable basis, span decades. Sustaining capital expenditure to maintain an oil sands project is significantly lower than U.S. shale, where you’re on a constant treadmill to find new acreage and drill high-decline wells. Despite all this, we don’t think Canadian E&Ps should trade at parity to U.S. E&Ps. While TMX is certainly a positive, we take stock in the fact that the pipeline will likely be full by 2027 and we end up having to ship the marginal barrels via rail once again. We will certainly see a few optimization/compression-type projects along the way that improve capacity incrementally, but only time will tell whether we will get another huge step function in Canadian egress in the coming years. TMX project was first submitted to the regulators in 2013, so it’s been a long time coming, with the latest cost overrun estimate at $30B+, or ~$800 per capita.

Final Thoughts

The bottom line for those looking at the Canadian energy space is to invest for the right reasons, and those are 1) step function increase in production, 2) lower volatility from better-realized pricing of WCS, 3) attractive (but not firesale) valuations for steady returns, and 4) outsized opportunities in the intermediates and juniors. Betting on the direction of oil, in our view, is not amongst the top reasons to invest in Canadian energy names, and we would rather focus on a sustainable approach where we pick producers that can generate outsized returns on a full-cycle basis at reasonable valuations.

— Jeremy Lin, CFA is a Portfolio Manager at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Disclaimers

Echelon Wealth Partners Inc.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional

advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.

Share this post